84

Finance

cial condition of the banking sector (including non-

bank financial institutions) in Zambia managed to

overcome the struggles and find success. All banks

remained adequately capitalized and operational.

As of 2013, the government of Zambia had exceed-

ed its national target of 50 percent financial inclu-

sion, and in 2015, 59 percent of adults were finan-

cially included.

INVESTMENT OPPORTUNITIES

The development of Multi-Facility Economic Zones

and Industrial Parks have contributed to a notable

influx of general investment in the country, which has

greatly benefited the country’s financial sector.

BANKING SYSTEM

The financial sector in Zambia is made up of banks

and non-bank financial institutions (NBFIs), which

are regulated and supervised by three agencies: the

Bank of Zambia (BoZ), the Pensions and Insurance

Authority (PIA), and the Securities and Exchange

Commission (SEC).

According to 2012 BOZ (Bank of Zambia) figures,

there are 19 commercial banks in Zambia, which

OVERVIEW

Zambia’s long period of political stability has undeni-

ably helped it reach lower middle-income status in

the last decade. Recently two Euro bonds were is-

sued, which serves as evidence of the confidence

investors are now placing in the country.

Rapid economic growth in the country has been ex-

perienced for more than a decade, and this can be

attributed to a number of measures undertaken by

the government. Prudent macroeconomic manage-

ment, market liberalization policies, and increases

in copper prices have helped drive investments

into the country, which have led to an average an-

nual growth of about 6.4% over the last decade. The

economy is mostly dependent on copper; however,

the agriculture sector is a major employer (70% of

the population).

The country’s Vision 2030 and the Sixth National

Development Plan have been recently revised, and

they are poised to create great improvements across

the financial sector. The development plan has been

organized to provide for “broad based wealth and

job creation through citizenry participation and tech-

nological advancement.” One of the primary goals

most affecting the finance sector is that of fostering a

competitive and outward-oriented economy.

Monetary

& Financial

Dev

el

opments

In 2005 and 2006, Zambia participated in the Highly

Indebted Poor Country (HIPC) and Multi-Donor Debt

Reduction Initiative (MDRI), which led to a large re-

duction in debt— from 7.2 billion USD to 0.5 billion

USD. This created a fiscal space for development,

which, along with excellent macroeconomic man-

agement and broad sector growth,

Despite the global financial crisis and its adverse im-

pact on banking systems globally, the overall finan-

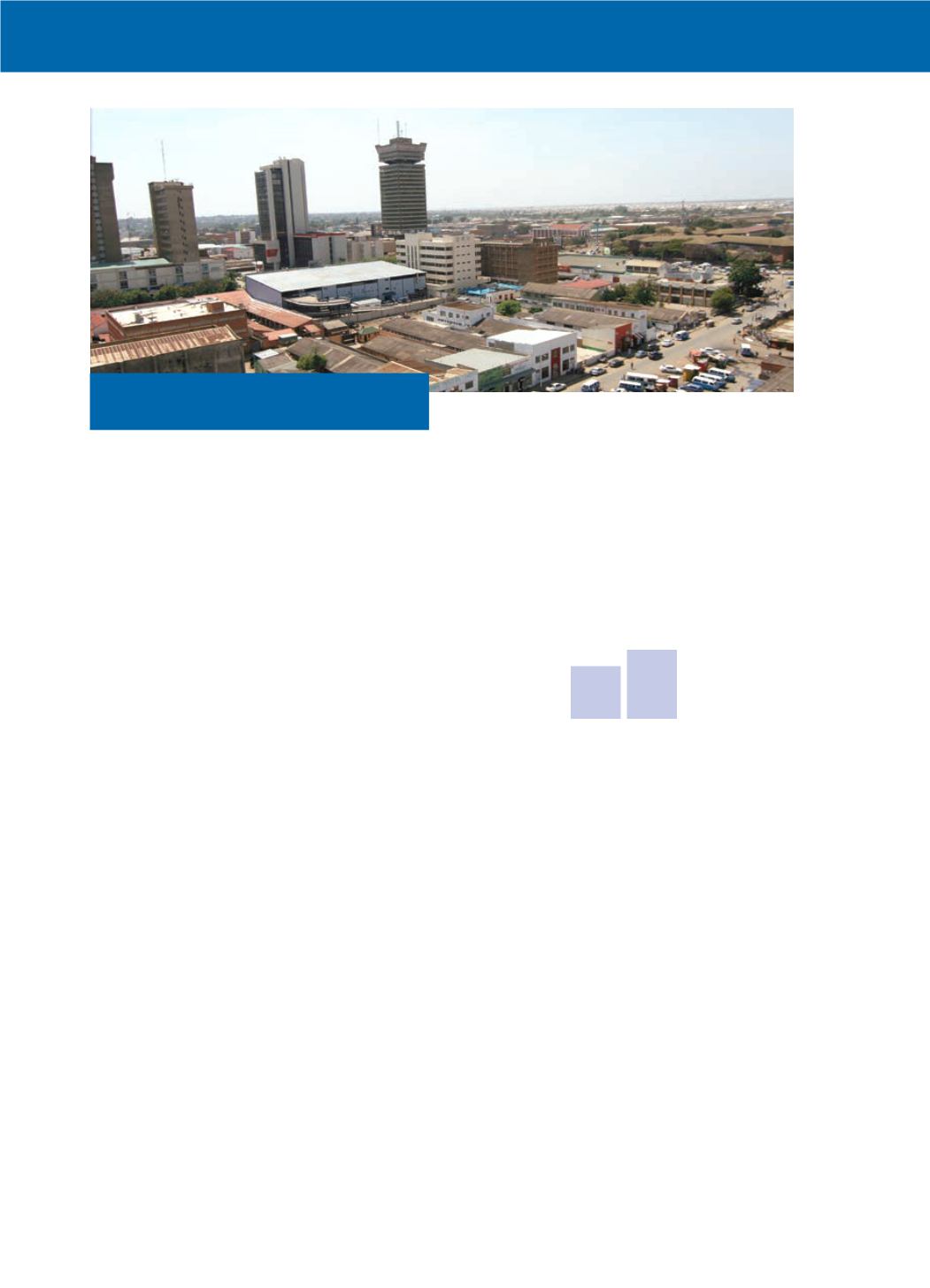

Credit: The Inzy Company

Lusaka from above

Financial

Incl

usion

2013

50%

2015

59%