76

Investment & Legal Framework

The Common Mark

et for

East and Southern Africa

Free Trade Area

The Common Market for East and Southern Africa

(COMESA) has been in existence, in one form or

another, since 1981. The COMESA Free Trade Area

(FTA) became operational on 1 November 2000 with

nine participating countries.

The COMESA FTA is an agreement in which mem-

bers agree to not apply customs duties or charges

on goods traded amongst themselves. Goods eli-

gible for duty-free trade must meet the requirements

set by the COMESA Rules of Origin. Members have

also agreed to eliminate all non-tariff barriers to

trade between them. The nine member states that

are implementing zero tariffs under the COMESA

framework are the following: Egypt, Sudan, Kenya,

Djibouti, Malawi, Madagascar, Mauritius, Zambia,

and Zimbabwe.

A COMESA Certificate of Origin is required for each

consignment of goods and is obtained from the Rev-

enue Authority of each respective member state.

The Southern African Dev

el

opment

Community

Members of the Southern African Development Com-

munity (SADC), made up of 15 countries, signed a

Trade Protocol, which calls for the implementation

of a Free Trade Area. Each country negotiated two

reduced tariff schedules. One schedule is applicable

only for South Africa and another schedule for all oth-

er SADC members. Zambia’s implementation, which

came into effect on 30 April 2001, is provided to those

countries that provide Zambia with the SADC reduced

tariff schedule.

The Tax Sy

stem

The Ministry of Finance and National Planning is re-

OVERVIEW

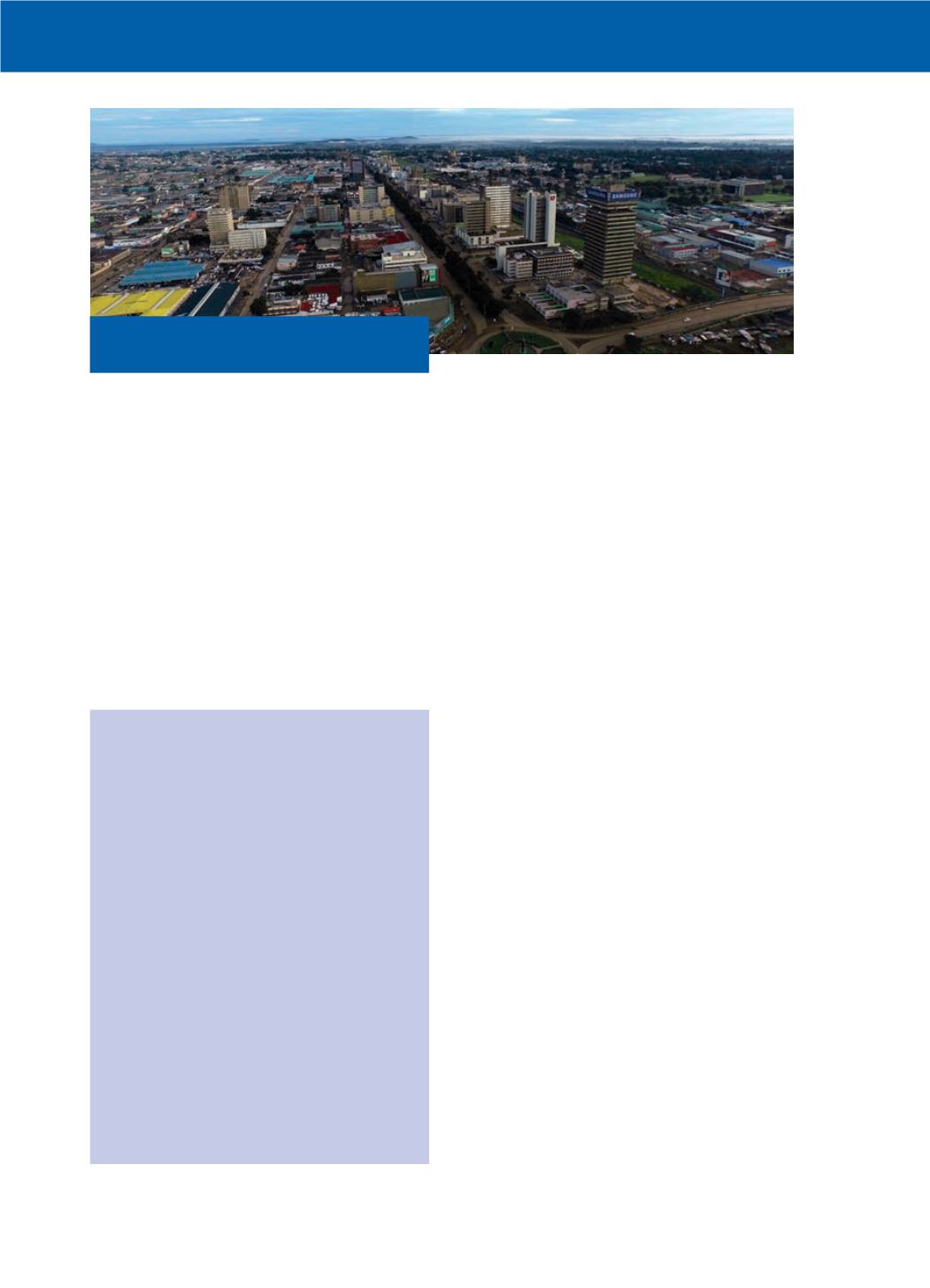

Zambia is a multi-party democracy, and it boasts a

market-oriented, liberalized economic environment.

Socially, the Zambian society is safe, strife-free, and

multicultural. The Zambian Government is extremely

welcoming to investors across all sectors, and it has

developed an investment and legal framework that

provides incentives for new and established investors

to enter the Zambian market. The government hopes

that the country’s friendly investment climate will re-

sult in an increase in the levels of investment, inter-

national trade, and lead to an increase in domestic

economic growth.

The following points represent some of the countries

key strengths that make it an ideal investment loca-

tion:

• Abundance of natural resources and manpower

• Political stability since gaining independence in

1964

• Abolition of controls on prices, interest rates, and

foreign exchange rates

• Free repatriation of debt repayments

• 100% repatriation of net profits

• Security provisions for investors through legislated

rights to full and market value compensation

• Duty Free access to regional, widerAfrican, and US

markets under SADC (Southern African Develop-

ment Community), COMESA/FTA (The Common

Market for East and Southern Africa), and AGOA

(African Growth and Opportunity Act) respectively

• Banking, Financial, Legal and Insurance services

of international standard as well as a reputable

Stock Exchange

• Double Taxation Agreements with a number of Eu-

ropean, North American, African, and Asian coun-

tries

• Comfortable place to work and live (climate, peo-

ple, nature, etc.)

• Thriving Private Sector

Credit: The Inzy Company

View over Lusaka city